Continues to Optimise Product Mix

Transforms into an Integrated Light-weight Solution Provider

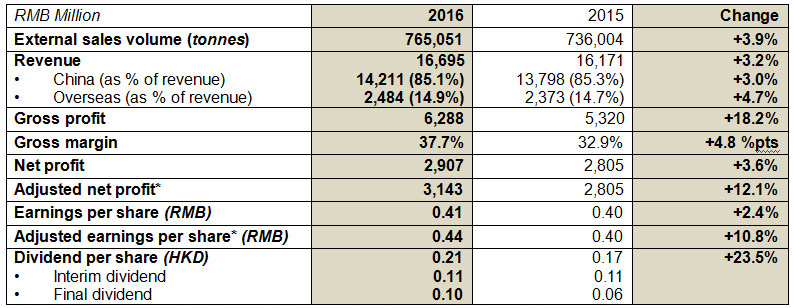

Financial Highlights (For the 12 months ended 31 December)

* Excluding non-recurring items which comprise the amortization of share option expenses and internal restructuring expenses incurred by the spin-off

(Hong Kong, 24 March 2017) - China Zhongwang Holdings Limited ("China Zhongwang" or the "Company", together with its subsidiaries the "Group", stock code: 01333), a world- leading fabricated aluminium product developer and manufacturer, announced its audited annual results for the year ended 31 December 2016 (“the Year under Review”). During the Year under Review, the Group’s external sales volume increased by 3.9% year-on-year to approximately 765,000 tonnes. The total revenue amounted to approximately RMB16.7 billion. Adjusted net profit rose by 12.1% to RMB3.14 billion and adjusted basic earnings per share rose to RMB 0.44. The Board recommended a final dividend of HKD0.10 per share for the financial year ended 31 December 2016. Together with the interim dividend of HKD0.11 per share, the dividend per share for the year totalled HKD0.21, equivalent to a dividend payout ratio of approximately 45.5% on a full-year basis.

Mr. Lu Changqing, President and Executive Director of China Zhongwang, said, “With the rising awareness of energy conservation and sustainable development, the downstream applications of aluminium is becoming more diversified and moving towards the high-end segments. The Chinese Government has implemented measures and policies, including tightening the fuel consumption restriction on petrol cars, optimizing grid network of China high-speed railways and having a more long-term development plans for the automobile industry, etc. These will bring business opportunities to aluminium alloys to be used in high value-added products such as main body and body frame of vehicles, large-section parts of trains and body parts of buses. While strengthening the sales of our existing high-end large-section parts and fabricated products, the Group implemented facility upgrade and fostered multi-faceted cooperation with customers, realising its transition into an integrated light-weight solution provider.”

Aluminium Extrusion Business-

Upgrade Production Capacity to Enhance Competitiveness

To meet the rising demand for high-end aluminium products, the Group is expanding and optimizing its production capacity. The Group entered into purchase contracts for 99 extrusion presses during the Year under Review. These equipments will commence production in phases in the coming two to three years. The adjustment and trial run of one of the two ultra-large 225MN extrusion presses ordered earlier are fully underway and is expected to commence production in the first half of 2017, while the other press is being installed.

Deep Processing Business-

Cooperated with Customers to Develop New Products

Sales volume of the Group’s deep processing business increased significantly by 22.7% to approximately 90,000 tonnes, bringing an increase of 25.1% in revenue to approximately RMB2.44 billion. The Group diversified its product mix by offering customers with more varieties of customised semi-finished and finished products, to enhance the Group’s competitiveness. During the Year under Review, sales volume of bus structure components, large parts for new energy vehicles and railway vehicles ect. increased considerably. Meanwhile, the Group fostered in-depth cooperation with a number of well-known domestic manufacturers of passenger cars and buses. The Group is the exclusive supplier of aluminium-intensive body parts for BEV model S51 jointly developed with Chery New Energy Automotive Technology Co., Ltd., and the supplier of aluminium extrusions for electric sports car model K50 developed under collaboration with CH-Auto Technology Co., Ltd..

Enhance Industry Chain Extension while Exploring Potential Markets

The first production line of the Group’s high value-added aluminium flat rolling project in Tianjin, supplies products in small quantities for customers from rail transit, machinery and equipment, and other industrial sectors. During the Year under Review, the smelting and casting mill and the hot rolling mill respectively produced the widest aluminium alloy slabs and plates in the industry, an attestment to the technological capabilities of the Group. Up to now, the project has not only been awarded several authoritative accreditations on environment management system, safety management system and so on, but also accredited with three quality management system accreditations, namely AS9100, TS16949 and ISO9001, demonstrating that the Company has successfully established and applied a quality management system commensurate with industry standards in the aviation and automobile industries. Moreover, the project has also passed the authoritative certification program Nadcap for the international aviation industry, and obtained the accreditation from Det Norske Veritas (DNV), and Nippon Kaiji Kyokai (NK). The credentials underpin the superior technological strength and excellent capability of the Group.

Phase I of the high-precision aluminium alloy processing project located in Yingkou is in full operation. During the Year under Review, the project supplied quality aluminium alloy billets for internal production, saving cost for the Group thus enhancing profitability. Phase II is currently under construction and is scheduled to commence production in 2017.

Mr. Lu concluded, “The development plans and policies of the Chinese Government created a favorable environment for fabricated aluminium manufacturers. The Group will be squarely focused on capacity expansion and industrial layout improvement to fully capitalize the synergy of our three core businesses, namely aluminium extrusion, deep processing and flat rolling. Our target is to become a competitive developer and manufacturer of high-end fabricated aluminium products. ”